- Home

- About Us

- Products

- Services

- News

- Contact

The Future of E-commerce Packaging to 2027

The growth in e-commerce packaging during the global pandemic is well reported, but what is predicted to happen next? What new challenges and innovations are already appearing on the horizon? Smithers Pira recently published a report on the future of e-commerce packaging to 2027, and I’ll explore key points with a focus on corrugated board e-commerce packaging.

Growth Continues

correlates to the predicteThe global e-commerce packaging market enjoyed a growth CAGR of 20% since 2017. While further growth is expected, the value sales growth rate will slow to around 9.8% CAGR to 2027. This strongly d growth in global e-commerce sales that eMarketer forecasts will grow to 23.6% of total retail sales by 2025, with global e-commerce sales worth more than $5.63 trillion by the end of 2022. Data suggests that annual growth in e-commerce will outstrip traditional retailing at least until 2025.

The growth of e-commerce packaging has close correlation to e-commerce sales growth. Packaging manufacturers are already responding to market demands by lightweighting; reducing raw material usage; increasing recycled content, eliminating void space, material substitution (plastic to paper) and reusable packaging. Innovation must continue apace to answer the demands from consumers, NGOs and governments to reduce the environmental impacts.

Dominant Package Choice

All packaging types are expected to grow during 2022–27, with corrugated boxes growing faster than other formats. The corrugated box market grew at 21% CAGR in 2017–22, and this figure is predicted to slow to a still healthy 10.5% CAGR to 2027. Corrugated board is the dominant packaging option and is used for 80% of all e-commerce packaging and is expected to grow to 83% of world e-commerce packaging value in 2027. Innovations such as improved 3D scanning and box-on-demand machinery will improve efficiencies and help drive the increased growth in corrugated boxes.

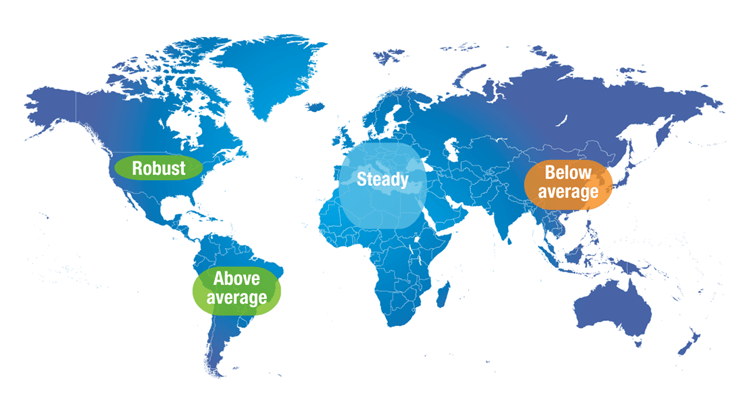

Global Markets

- The maturity of the market in China, Japan and South Korea slows the growth in Asia Pacific; however, the region still accounts for over 50% share of the global e-commerce packaging value.

- North America will enjoy robust growth, relative to other e-commerce markets.

- Brazil and Argentina are driving South and Central America e-commerce development, and will see above average growth

- Western Europe remains steady with growth forecasts boosted by Spain, Italy, and Nordic countries.

E-commerce Consumer Shopping Trends

As technology innovation continues, consumer shopping habits are forecasted to change as opportunities to purchase become easier.

As technology innovation continues, consumer shopping habits are forecasted to change as opportunities to purchase become easier.

m-Commerce, or online sales via mobile devices, is likely to grow into 2027 with the largest gains in developing markets. Smaller markets will enjoy growth as smartphone penetration increases, online retail platforms become more sophisticated, with warehousing and logistics infrastructures improving.

Shopping via a smart speaker can create a personalized shopping experience. With an estimated 621 million smart speakers sold since 2016, data suggests the number of digital voice assistants will reach 8.4 million by 2024. Data from Voicebot indicates that global voice commerce transactions will reach a value of $164 billion by 2025, up from $22 billion in 2020.

Shopping via a smart speaker can create a personalized shopping experience. With an estimated 621 million smart speakers sold since 2016, data suggests the number of digital voice assistants will reach 8.4 million by 2024. Data from Voicebot indicates that global voice commerce transactions will reach a value of $164 billion by 2025, up from $22 billion in 2020.

Evolving Consumer Attitudes Driving Behavior Change

Sustainability concerns remains high on the consumer agenda. Common areas of concern are the amount of packaging used, over-reliance on single-use plastics and whether the packaging is recyclable.

A Two Sides survey conducted in early 2020 found that 57% of the 5,700 Europeans surveyed preferred online orders to be delivered in paper or board packaging and that 57% made a conscious effort to reduce their use of plastic packaging. A large majority of 70% wanted minimal packaging, and 38% claimed they would spend more on a product if sustainable packaging materials were used.

A Two Sides survey conducted in early 2020 found that 57% of the 5,700 Europeans surveyed preferred online orders to be delivered in paper or board packaging and that 57% made a conscious effort to reduce their use of plastic packaging. A large majority of 70% wanted minimal packaging, and 38% claimed they would spend more on a product if sustainable packaging materials were used.

Consumer knowledge of environmental issues is at an all-time high, and many millennials and Generation Z refuse to interact with brands that do not embed sustainability in their business strategy. They are looking for responsible sourcing of raw materials, carbon footprint reduction and end-of-life solutions.

Remaining high on the list of consumer complaints [dissatisfaction] is inefficient e-commerce packaging. This occurs the most, when standard sized corrugated boxes in fulfillment centers do not match the product size. The report claimed that eliminating this empty or void space could generate annual savings of $46 billion.

As new concerns emerge, the more traditional consumer influences for online shopping choice remain strong. These include factors such as dependable and/or free delivery, a free returns policy and a reliable website for ordering. Delivery speed and flexibility remains a major factor.

Social Media Heightens Consumer Expectations

A new category of packaging has developed that is designed to give the consumer a heightened experience they will want to share on social media. ‘Experience’ packaging is becoming especially prevalent in markets where a stronger association exists between branding and packaging, such as luxury goods market. According to the US-based logistics firm 2Flow: 52% of consumers are likely to make repeat purchases if online retailers supply premium packaging that gives the recipient an opportunity to share images on social media, with one in five consumers watching an unboxing video.

This demonstrates that in 2022, consumers have heightened expectations of online interactions, and this is prompting more and more retailers to develop increasingly memorable packaging and unboxing experiences.When a brand perfects this process, consumers share their experience in person or via social media, acting as a free advertising tool, whilst also building brand loyalty. Brands pushing the boundaries of premium packaging have introduced personalized and customized packaging, perfectly designed for unboxing videos. This positive unboxing experience entices consumers to sign up to product subscriptions. According to PR Newswire, the value of the subscription-based e-commerce market grew exponentially during the pandemic and has a market value of $120 billion in 2022.

Regulation Impacting E-commerce Packaging

Government regulation and legislation will continue to play a key role in shaping the e-commerce packaging market. For any company considering placing a new e-commerce package on the market, there are several regulations that must be considered, i.e. The Green Deal. Some apply regionally, others at a local level. The largest direct impact on e-commerce packaging in Europe is the plastics packaging tax, introduced in January 2021 with implementation continuing to spread across member states.

Government regulation and legislation will continue to play a key role in shaping the e-commerce packaging market. For any company considering placing a new e-commerce package on the market, there are several regulations that must be considered, i.e. The Green Deal. Some apply regionally, others at a local level. The largest direct impact on e-commerce packaging in Europe is the plastics packaging tax, introduced in January 2021 with implementation continuing to spread across member states.

Over the coming years, government regulation will continue to drive e-commerce packaging decision making, particularly in relation to the materials used and end-of-life solutions. To answer the evolving needs of the regulations, R&D investment in new materials will increase exponentially as retailers plan their packaging portfolios with significantly less plastic. Alternatives, such as mycelium, wool, seaweed, and cornstarch, are already being used in consumer packaging. Retailers will continue to increase their use of paper-based packaging materials and ensure any plastic packaging has over 30% recycled content to counter regulations against single-use plastics. Additionally, retailers will look to increase the amount of reusable packaging in their portfolio although this market area has not developed as hoped.

Challenges Appearing on the Horizon

The world of e-commerce packaging has continually developed and overcome many challenges over the past few years. What will be the next challenges to face the industry?

-

4th Floor,No.428 Wenzhou Avenue,Puzhou Street,Longwan,Wenzhou,China,

-

+86-577-66688057

+86-18058846873 -

Copyright © 2019 CHINA . Wenzhou Andy Printing Machine Factory and Suppliers.